Spread Option Calculator . an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. See visualisations of a strategy's return on investment by possible future stock prices. put spread calculator shows projected profit and loss over time. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. select between a call spread and a put spread option strategy and calculate the corresponding payoff. With it, you can calculate complex options spreads. A put spread, or vertical spread, can be used in a volatile market to. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies.

from optionstradingiq.com

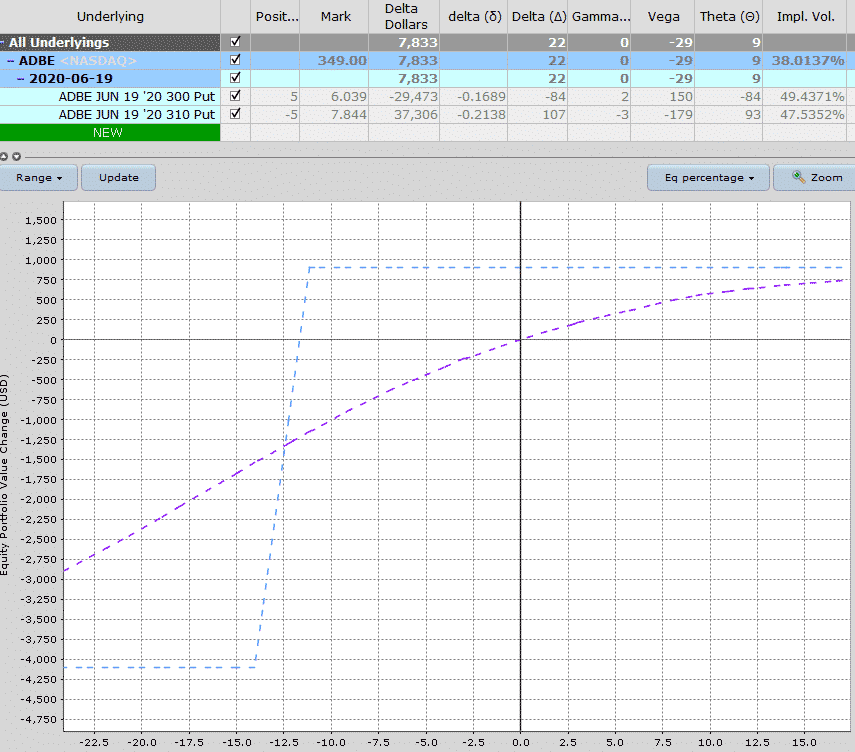

an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. select between a call spread and a put spread option strategy and calculate the corresponding payoff. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. With it, you can calculate complex options spreads. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. put spread calculator shows projected profit and loss over time. See visualisations of a strategy's return on investment by possible future stock prices. A put spread, or vertical spread, can be used in a volatile market to.

bull call spread calculator Options Trading IQ

Spread Option Calculator With it, you can calculate complex options spreads. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. A put spread, or vertical spread, can be used in a volatile market to. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. put spread calculator shows projected profit and loss over time. With it, you can calculate complex options spreads. See visualisations of a strategy's return on investment by possible future stock prices. select between a call spread and a put spread option strategy and calculate the corresponding payoff.

From calculatorshub.net

Vertical Spread Calculator Online Spread Option Calculator select between a call spread and a put spread option strategy and calculate the corresponding payoff. See visualisations of a strategy's return on investment by possible future stock prices. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. put spread calculator shows projected profit and loss. Spread Option Calculator.

From www.warsoption.com

The Bear Call Credit Spread The Most Used Bearish Strategy Spread Option Calculator put spread calculator shows projected profit and loss over time. A put spread, or vertical spread, can be used in a volatile market to. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. With it, you can calculate complex options spreads. a bull call spread calculator is. Spread Option Calculator.

From kasamkennedi.blogspot.com

KasamKennedi Spread Option Calculator select between a call spread and a put spread option strategy and calculate the corresponding payoff. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. put spread calculator shows projected profit and loss over time. See visualisations of a strategy's return on investment by. Spread Option Calculator.

From exceltradingmodels.com

Free Spread Trading Contract Calculator in Excel Excel Trading and Spread Option Calculator With it, you can calculate complex options spreads. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. calculate potential profit, max loss, chance of profit,. Spread Option Calculator.

From db-excel.com

Option Strategy Excel Spreadsheet — Spread Option Calculator a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. put spread calculator shows projected profit and loss over time. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. select between a call spread. Spread Option Calculator.

From shelf.definedgesecurities.com

Diagonal Spread Options Strategy Definedge Securities Shelf Spread Option Calculator select between a call spread and a put spread option strategy and calculate the corresponding payoff. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. A put spread, or vertical spread, can be used in a volatile market to. calculate potential profit, max loss,. Spread Option Calculator.

From purrgramming.life

Introduction to Options Purrgramming Spread Option Calculator calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. put spread calculator shows projected profit and loss over time. With it, you can calculate complex options spreads. a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of. Spread Option Calculator.

From eztrade.com

Option Matrix Analyzer Spread Option Calculator put spread calculator shows projected profit and loss over time. A put spread, or vertical spread, can be used in a volatile market to. See visualisations of a strategy's return on investment by possible future stock prices. With it, you can calculate complex options spreads. a bull call spread calculator is a specialized financial calculator used to evaluate. Spread Option Calculator.

From www.macroption.com

Option Strategy Payoff Spreadsheet Further Improvements Macroption Spread Option Calculator select between a call spread and a put spread option strategy and calculate the corresponding payoff. See visualisations of a strategy's return on investment by possible future stock prices. With it, you can calculate complex options spreads. A put spread, or vertical spread, can be used in a volatile market to. put spread calculator shows projected profit and. Spread Option Calculator.

From www.optionistics.com

Diagonal Put Spread Calculator Spread Option Calculator a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. See visualisations of a strategy's return on investment by possible future stock prices. With it, you can. Spread Option Calculator.

From www.twoinvesting.com

Options Tracker Spreadsheet Two Investing Spread Option Calculator A put spread, or vertical spread, can be used in a volatile market to. See visualisations of a strategy's return on investment by possible future stock prices. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. a bull call spread calculator is a specialized financial calculator used. Spread Option Calculator.

From marketxls.com

Options Profit Calculator Using Excel Template MarketXLS Spread Option Calculator a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. See visualisations of a strategy's return on investment by possible future stock prices. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. A put spread, or. Spread Option Calculator.

From unofficed.com

Construction of Options Spreads Session Learn about Vertical Spread Spread Option Calculator a bull call spread calculator is a specialized financial calculator used to evaluate the potential risks and returns of the bull call. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and. Spread Option Calculator.

From db-excel.com

Stock Options Spreadsheet Spreadsheet Downloa stock options portfolio Spread Option Calculator select between a call spread and a put spread option strategy and calculate the corresponding payoff. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. a. Spread Option Calculator.

From optionstrat.com

Using OptionStrat's Options Profit Calculator OptionStrat Spread Option Calculator an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. A put spread, or vertical spread, can be used in a volatile market to. select between a call spread and a put spread option strategy and calculate the corresponding payoff. calculate potential profit, max loss, chance of profit,. Spread Option Calculator.

From www.macroption.com

Bull Call Spread Option Strategy Payoff Calculator Macroption Spread Option Calculator See visualisations of a strategy's return on investment by possible future stock prices. With it, you can calculate complex options spreads. put spread calculator shows projected profit and loss over time. A put spread, or vertical spread, can be used in a volatile market to. a bull call spread calculator is a specialized financial calculator used to evaluate. Spread Option Calculator.

From www.macroption.com

Bull Call Spread Option Strategy Payoff Calculator Macroption Spread Option Calculator With it, you can calculate complex options spreads. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. See visualisations of a strategy's return on investment by possible future stock prices. put spread calculator shows projected profit and loss over time. select between a call spread and a. Spread Option Calculator.

From www.educba.com

BidAsk Spread Formula Calculator (Excel template) Spread Option Calculator calculate potential profit, max loss, chance of profit, and more for calendar call spread options and over 50 more strategies. select between a call spread and a put spread option strategy and calculate the corresponding payoff. an options spread calculator is designed to calculate potential profits, losses, and breakeven points in options spread trading scenarios. See visualisations. Spread Option Calculator.